SUPPORT US

A non-profit organization, Children's Village relies on funding from the community.

Since our 1976 inception, we have educated thousands of young children and supported their families, always guided by the highest quality standards.

We can only continue to do so with you.

Donate by Check

Please make check payable to Children’s Village and mail to:

Mary Graham, Executive Director

Children’s Village

125 North 8th Street

Philadelphia, PA 19106

Questions about making a gift?

Please contact our Development Director:

Ingrid Jauss

ingridj@childrensvillagephila.org

Other Ways to Support Us

You can support Children’s Village in a number of ways.

Explore the links below to learn more.

Committed to Transparency and Accountability

Children’s Village has received the 2023 GuideStar Platinum Seal of Transparency, a leading symbol of transparency and accountability provided by GuideStar USA, Inc., the premier source of nonprofit information. To learn more, visit our GuideStar report page.

A copy of Children’s Village official registration and financial information may be obtained from the Pennsylvania Department of State by calling toll-free, within PA, 1-800-732-0999. Registration does not imply endorsement.

We are pleased to present a report on our recent activities and funding through our most recent Annual Report.

As a Children’s Village donor, you have entrusted to our care not only your charitable gifts, but your personal information as well. We thank you for your trust and, in turn, promise to protect both your gift and your information in keeping with the highest ethical standards and industry practices. Review our Donor Privacy Policy.

HONOR OTHERS THROUGH TRIBUTE AND MEMORIAL GIFTS

Tribute gifts are a meaningful way to honor others.

You can:

Express your appreciation to teachers or other members of our staff with a gift in their honor.

Celebrate a birthday, anniversary or other special occasion with a gift.

Honor the memory of loved one in a meaningful way.

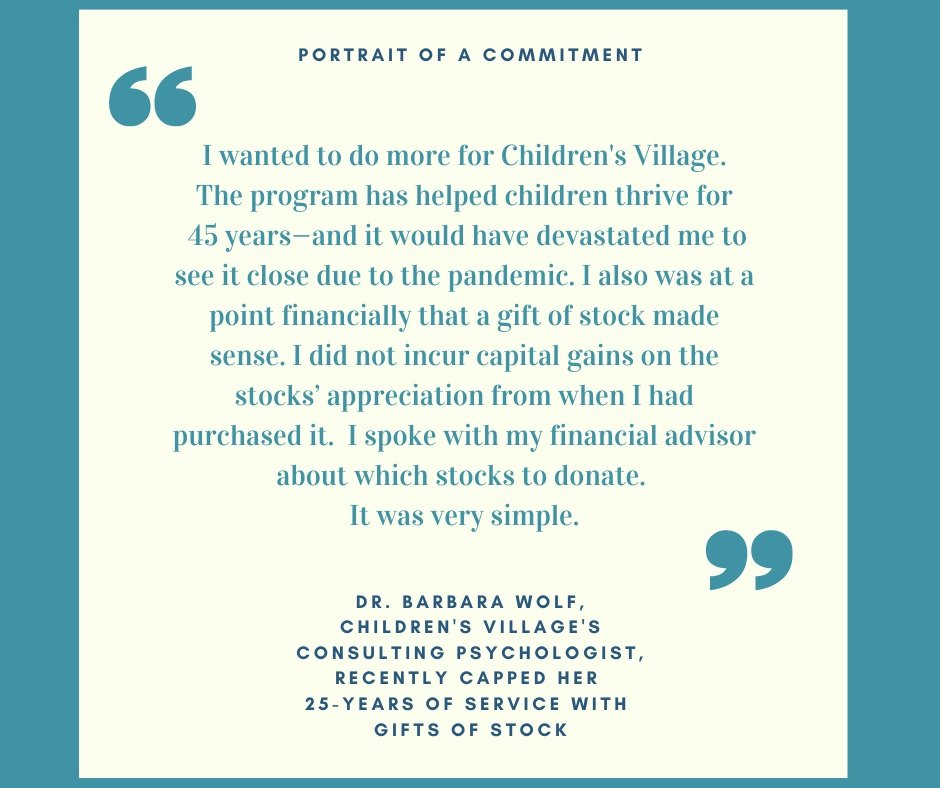

GIFTS OF STOCK

Donating stocks, especially those that have appreciated, to Children’s Village may offer you significant tax benefits while providing much-needed funds for our program.

When you transfer ownership of appreciated stock to Children’s Village, you receive a charitable deduction for the stock’s full market value—and you incur no capital gains tax (subject to IRS deduction limits). By making this type of stock gift, you can avoid paying capital gains tax that would otherwise be due if you sold these assets.

Please email Ingrid Jauss (Ingridj@chldrensvillagephila.org), Development Director, for simple instructions on how to initiate the stock transfer to our broker. As always, we recommend that you consult a tax professional with any specific questions. Thank you!

LEAVE A LEGACY

Touch the Lives of Children through a Gift in your Will

A gift through your will enriches the lives of children for years to come. You can direct a specific dollar amount or a percentage of your estate.

Every gift is needed and appreciated—and will make a lasting difference.

Please contact your financial adviser to include a bequest in your will to Children’s Village.

UNITED WAY

Children’s Village’s Donor Choice number: 1182

Consider directing a portion of your United Way contribution to Children’s Village.

GIVE Now to Children’s Village at unitedforimpact.org.

Educational Improvement Tax Credit (EITC)—Pre-Kindergarten Scholarship Organization Program

A Win-Win for Businesses and Young Learners

Established by Pennsylvania in 2001, the EITC PKSO program provides extraordinary business tax credits in exchange for donations to EITC-approved Pre-Ks like Children's Village:

100% of very dollar donated up to $10,000

90% of every dollar donated thereafter up to $200,000

Maximun donation: $200,000 annually

Your business liability is transformed into support for preschoolers in need.

EITC business tax credits significantly reduce the actual ‘cost’ of your donation:

FAQs

Who administers EITC?

EITC is administered by PA’s Department of Community and Economic Development (DCED).

Learn more about the EITC at dced.pa.gov. Since EITC's 2001 inception, Children's Village's preschoolers have been its beneficiaries.

Find the EITC Business Guidelines HERE.

What businesses are eligible to participate?

Firms authorized to conduct business in PA that pay PA taxes are eligible.

What taxes can be offset by a donation to Children's Village as Pre-K Scholarship Organization (PKSO)?

Personal Income; Tax Capital Stock/Foreign Franchise Tax; Corporate Net Income Tax; Bank Shares Tax; Title Insurance & Trust Company Shares Tax; Mutual Thrift Tax; Malt Beverage Tax; Insurance Premium Tax; (excluding unauthorized, domestic/foreign marine); Surplus Lines Tax

Where can I find the EITC Business Guidelines and online application—and how do I submit the application?

You can find the Business Guidelines, online application, and helpful tips at the PA Department of Community and Economic Development EITC webpage HERE. All applications must be completed and submitted online using the Pennsylvania Department of Community and Economic Development’s (DCED) SINGLE APPLICATION for assistance.

When are applications accepted? Is there an application deadline?

Initial applications are accepted starting in early July (typically July 1). Reoccurring applications are accepted in mid-May. There is no application deadline, however, applications are reviewed on a first-come, first-serve basis so it is best to apply as early in July as possible. For the simple steps involved in obtaining the credits and making the contribution, see below!

Remember! When your application has been approved, designate your contribution to Children’s Village Child Care Center Scholarship Fund.

FIND THE ONLINE EITC BUSINESS APPLICATION HERE!

FIND CHILDREN’S VILLAGE EITC BROCHURE HERE!

Making An Impact That Lasts A Lifetime

Last year, businesses participating in the Pre-Kindergarten Tax Credit Program earned tax credits — and, in turn, opened the door to academic success for many children in need.

Who can I contact at Children’s Village with questions?

Please contact Children’s Village Development Director Ingrid Jauss IngridJ@childrensvillagephila.org or (215) 931-0196.

EDUCATIONAL IMPROVEMENT TAX CREDIT—SPECIAL PURPOSE ENTITY

(EITC SPE)

Sponsored by the state of Pennsylvania, the Educational Improvement Tax Credit (EITC) Special Purpose Entity (SPE) is a powerful giving opportunity that allows you to:

Significantly reduce the out-of-pocket cost of your gift with a PA income tax credit of 90% of your donation

Direct where your PA tax dollars are spent—to Children’s Village.

100% of your donation benefits preschoolers in need in our nationally accredited program.

Who Can Participate?

Individuals or married couples filing jointly with a PA income tax liability of $3,500 or more annually.

To see if you may qualify, find your PA tax liability on Form PA-40 Line 12 of your most recent tax return.Minimum donation of $3,500

A Simple Process—A Powerful Impact

Children's Village partners with the Central Pennsylvania Scholarship Fund (CPSF) to manage these donations. CPSF processes the contributions and provides the tax documents.

Read CPSF's FAQ here.

Here are the simple steps:

Find the application HERE.

Deadline/Contact Details

Applications are accepted throughout the year, however, credits are distributed on a first-come, first serve basis. To benefit on your 2023 PA income taxes, submit the application asap -- (and before December 31, 2023!)

Email the completed Joinder to: Tami Clark, Executive Director, CPSF, tami@cpsfcharity.org , and

Please CC Ingrid Jauss, Development Director, Children's Village, at Ingridj@childrensvillagephila.org.

Questions?

Email or call Ingrid Jauss at 215.931.0196

MAKE A DIFFERENCE IN THE LIVES OF CHILDREN, VOLUNTEER!

Would you like to be part of a warm, vibrant classroom community?

A school-age student needs your help with her homework.

A toddler wants to cuddle up to you and hear a story.

A preschool group wants to hear about your job when they are studying community helpers.

The Librarian can use help repairing, covering, and organizing books.

A group of children visiting the library would like to hear you tell a story.

Think about dedicating an hour or two each week to a class at Children’s Village. It will be an experience neither you nor the children will ever forget!

I’m Interested In Volunteering! How Do I Get Started?

First, complete the Application for Employment and Volunteering at Children’s Village and return it to the contact information listed at the bottom of this page.

What Happens Next?

Children’s Village will contact qualified candidates to schedule an interview. We want to ensure we match your interests and skills with the available volunteer opportunities here at Children’s Village.

Please keep in mind that the requirements that are listed below are the minimum for volunteers at Children’s Village. There is other paperwork at Children’s Village you will be required to complete before you start. Some volunteer positions may also require additional documents or clearances.

Children’s Village is a drug-free environment. All volunteers must complete drug and alcohol screening. Children’s Village will provide you with information about the screening, which must be completed before you join us as a volunteer.

You will need to provide proof (your receipt) indicating that you have submitted the following three applications to the respective agencies:

Pennsylvania Child Abuse History Clearance. Please download information here: Child Abuse Clearance. You must submit request for Child Abuse History Clearance Online.

Pennsylvania State Police Criminal History Record. Please download information here: PA Criminal Background Clearance 2015. You must submit request for Criminal History Record Online.

Pennsylvania Department of Public Welfare Applicant Fingerprinting Services Online Registration. Please visit pa.cogentid.com and click on the Department of Public Welfare (DPW).

In addition, you will need to provide Children’s Village with:

Child Care Staff Health Assessment (which includes tuberculosis screening) that has been completed by a physician. You can download the Child Care Staff Health Assessment.

Proof of educational experience (official transcripts and copies of diplomas)

Proof of work experience (if one of your letters of reference is from a current or former employer, ask the employer to include your start date and average hours worked per week, and end date, if applicable)

Two forms of identification (one must provide proof of age)

Qualified persons interested in volunteering at Children’s Village are encouraged to mail, fax, or e-mail the Application for Employment and Volunteering at Children’s Village to:

Children’s Village

125 North 8th Street

Philadelphia, PA 19106

Phone: (215) 931-0190

Fax: (215) 413-2102

Email: info@childrensvillagephila.org

Thank you!